- +971 501371105

- info@baarez.com

- USA | UAE | Qatar | Singapore | India | Latvia

Drive Compliance, Minimize Risks, and Ensure Business Continuity with Baarez Technology Solutions.

Our AI-powered GRC platform uses intelligent analytics and automation to detect, classify, and prioritize risks, ensuring your business stays ahead of potential threats and maintains full compliance.

Get started by speaking to our team today.

GRC services for manufacturing ensure compliance with environmental regulations, safety standards, and industry certifications like ISO 9001. They help manage supply chain risks, product quality, and workplace safety while monitoring compliance with labor and anti-corruption laws. GRC solutions streamline auditing, regulatory reporting, and risk management processes to maintain operational efficiency.

GRC services for manufacturing ensure compliance with environmental regulations, safety standards, and industry certifications like ISO 9001. They help manage supply chain risks, product quality, and workplace safety while monitoring compliance with labor and anti-corruption laws. GRC solutions streamline auditing, regulatory reporting, and risk management processes to maintain operational efficiency.

In healthcare, GRC services ensure compliance with HIPAA, HITECH, and GDPR to protect patient data. They manage risks related to clinical trials, patient safety, and medical device regulations. GRC tools monitor policies, track regulatory updates, and enforce industry-specific security standards, reducing penalties and operational disruptions.

In aviation, GRC services ensure compliance with FAA, EASA, and IATA regulations, helping manage risks related to safety, maintenance, and cybersecurity. GRC tools track regulatory changes, monitor pilot and aircraft certifications, and enforce security protocols. They minimize risks of accidents, penalties, and grounding, ensuring operational safety and adherence to international standards.

Contact us and we’ll answer any questions about how Baarez can help

you improve your Governance, Risk and Compliance.

GRC stands for Governance, Risk, and Compliance. It is a strategic framework designed to ensure that an organization effectively manages risks, complies with relevant laws and regulations, and establishes strong governance policies for decision-making and performance monitoring.

GRC services are typically broken down into three main areas:

GRC helps businesses:

GRC services are applicable to a wide range of industries, including:

Common regulations and standards that GRC services address include:

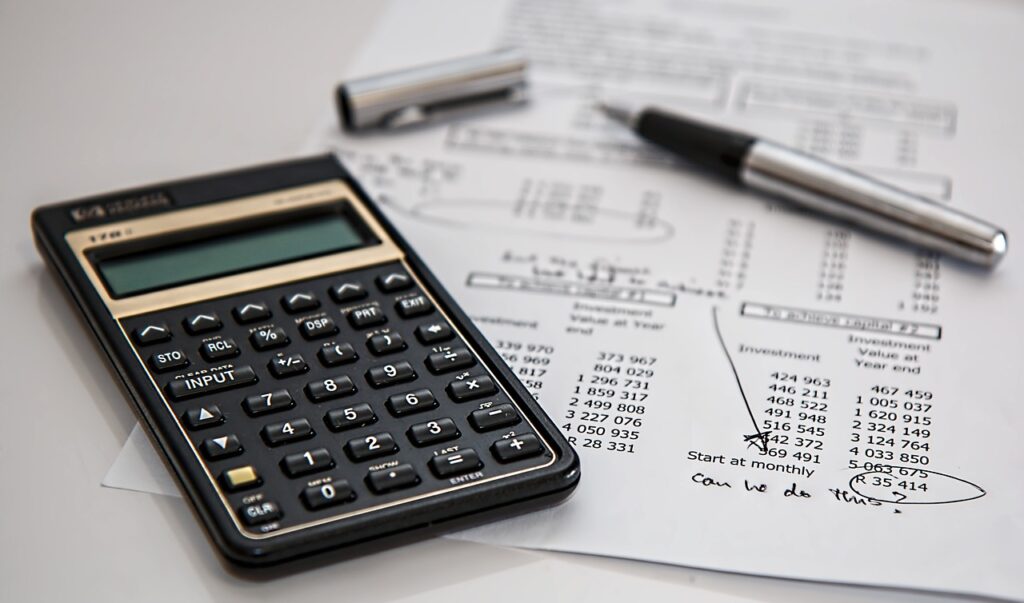

GRC services help businesses identify and assess potential risks in key areas such as financial operations, cybersecurity, supply chains, and legal exposure. GRC frameworks enable businesses to develop risk mitigation strategies and continuously monitor these risks to minimize their impact.

Yes, GRC services are highly customizable. Every organization has unique governance structures, risk appetites, and compliance requirements, and GRC services can be tailored to meet those specific needs. A GRC provider will often assess your business to develop a solution that fits your size, industry, and regulatory environment.

By integrating governance, risk, and compliance, GRC helps organizations make more informed decisions. With a clear view of risks, compliance obligations, and governance guidelines, business leaders can make strategic decisions that align with their risk tolerance, business goals, and regulatory requirements.

Without a GRC framework, organizations face several risks:

Office No.15, 2nd Floor, MISR Insurance Building, C-ring Road, Doha, Qatar

1942 Broadway St. STE 314C Boulder CO 80302 US.

No. 202, Saha Offices (C), Souk Al Bahar, Downtown Dubai, UAE.

Vasanth Vihar, Thane – Mumbai, Maharashtra, India.

Punggol Field

Walk #16-20,

Flo Singapore 828743.

Copyright © 2025 Baarez Technology Solutions - All rights reserved.